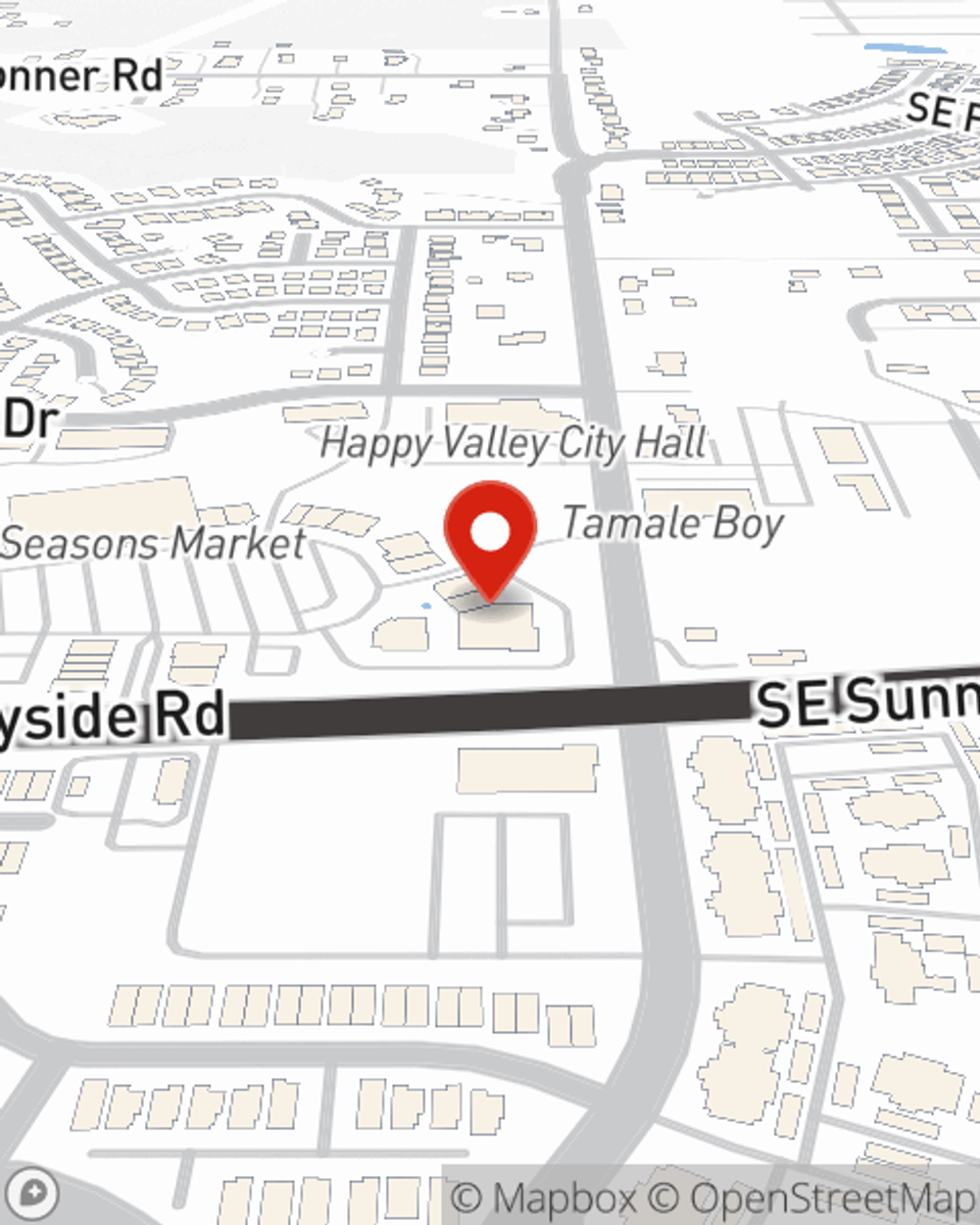

Homeowners Insurance in and around Happy Valley

A good neighbor helps you insure your home with State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

It's so good to be home, especially when your home is insured by State Farm. You never have to be uneasy about the unexpected with this terrific insurance.

A good neighbor helps you insure your home with State Farm.

Help cover your home

Safeguard Your Greatest Asset

State Farm Agent Blake Inabnit is ready to help you navigate life’s troubles with great coverage for your home insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Blake Inabnit can help you submit your claim. Find your home sweet home with State Farm!

Now that you're convinced that State Farm homeowners insurance is right for you, contact Blake Inabnit today to find out next steps!

Have More Questions About Homeowners Insurance?

Call Blake at (503) 427-2955 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to protect a vacant house after moving

How to protect a vacant house after moving

If your former home hasn't sold, your vacant home could fall victim to potentially costly issues. Consider these tips for vacant property protection.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Blake Inabnit

State Farm® Insurance AgentSimple Insights®

How to protect a vacant house after moving

How to protect a vacant house after moving

If your former home hasn't sold, your vacant home could fall victim to potentially costly issues. Consider these tips for vacant property protection.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.